Navigating the Regulatory Maze: How Tecpinion’s Partnerships help Global Operators Stay Ahead in Compliance and Multi-currency Payments

Table of Contents

Introduction

The global payments landscape is becoming increasingly complex as businesses, like the online gambling software and gaming industry, expand across borders. With more online shopping and international trade, companies need fast and secure ways to send and receive money. But every region has its own rules—like AML and KYC laws—making it hard to stay compliant. So, how can global B2B businesses keep up with these rules while handling many currencies?

Breaking these rules can lead to big fines, fraud risks, and damage to a company’s reputation. To help, Tecpinion partners with RegTech firms, banks, and regulators. These partnerships make it easier for businesses to follow global rules, reduce risks, and manage smooth, multi-currency payments.

In the following sections, we will explain the different types of Tecpinion’s partnerships and how each one helps global operators stay ahead in compliance and payments.

Current Market Stats

The global online gambling industry is anticipated to generate projected revenues of US$153,566.1 million by 2030. The global online gambling industry is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030.

Key Challenges: Compliance, Payments, Operations

-

Compliance Challenges :

Compliance means following the legal rules of the countries where an operator works. This is tricky in online gambling because rules differ from one place to another.

- Different Licensing Rules: Every country may require its own license. Some markets have strict rules about age verification, anti-money laundering, and responsible gaming.

- Changing Laws: Regulations change often, so operators must stay updated to avoid fines or shutdowns.

- Data Privacy: Laws like GDPR in Europe or CCPA in California require safe handling of player data. Breaking these rules can lead to heavy penalties.

- Operational Risk: Not following the rules can hurt reputation, cause license loss, or even lead to legal trouble.

-

Payment Integration Challenges:

Handling payments efficiently is key to keeping players happy and maintaining revenue.

- Multi-Currency Support: Players want to pay in their own currency, which requires dynamic conversion and accounting.

- Payment Security: Transactions must be secure to prevent fraud or financial loss.

- Multiple Payment Methods: Different regions prefer different methods like credit cards, e-wallets, bank transfers, mobile payments, or crypto. Integrating all of them can be complex.

- Regulatory Restrictions: Some countries limit certain payment types, so operators must adjust.

-

Cross-Border Operations Challenges:

Running a business in multiple countries adds extra complexity due to different laws, currencies, and cultures.

- Different Regulations: Operators must deal with multiple licenses, tax rules, and advertising laws at once.

- Currency Management: Operators need real-time exchange rates, multi-currency wallets, and accurate transaction tracking.

- Cultural & Language Differences: Platforms must be localized for different languages, user interfaces, and regional preferences.

- Operational Coordination: Managing servers, customer support, and marketing across regions requires good infrastructure and planning.

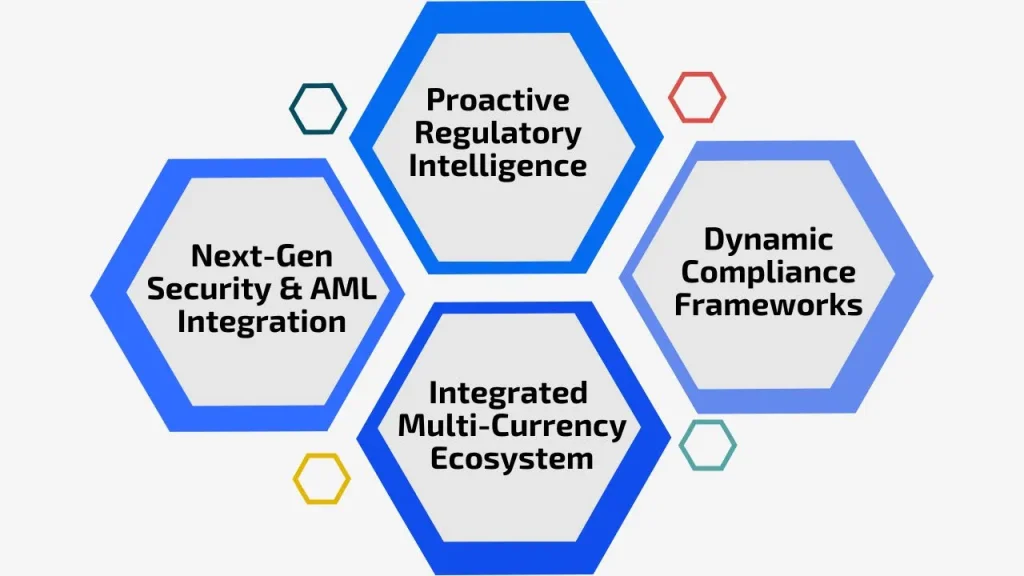

Tecpinion’s Partnership Approach: A Unique Edge

-

Proactive Regulatory Intelligence

What it means: Tecpinion is a leading software provider that goes beyond basic payment processing — offering intelligent currency conversion, dynamic wallet management, and a localized player experience.

Why it’s valuable:

1. Prevents costly disruptions caused by sudden rule changes.

2. Keeps Tecpinion and its clients fully compliant across jurisdictions.

3. Builds trust with regulators through local insight and foresight.

Example: If a new gambling law is being discussed in a country, Tecpinion’s local partners can flag it early, allowing quick adaptation before enforcement begins. -

Dynamic Compliance Frameworks

What it means: Tecpinion uses adaptive compliance systems that can automatically adjust to different regional laws and requirements — in real time.

Why it’s valuable:

1. Reduces manual effort in compliance updates.

2. Enables rapid entry into new markets.

3. Keeps operations running smoothly despite changing legal landscapes.

Example: If deposit limits or KYC (Know Your Customer) standards differ between countries, the platform automatically enforces the correct local rule without downtime. -

Integrated Multi-Currency Ecosystem

What it means: Tecpinion’s platform goes beyond basic payment processing — it offers intelligent currency conversion, dynamic wallet management, and a localized player experience.

Why it’s valuable:

Players can transact seamlessly in their preferred currency.

2. Smart conversions optimize rates and minimize costs.

3. Enhances user satisfaction and trust through a tailored, local feel.

Example:

A player in Brazil can deposit in BRL, while another in Europe uses EUR — both get a seamless experience, with currency handled intelligently in the background. -

Next-Gen Security & AML Integration

What it means: Tecpinion teams up with local experts who know the rules in each market. These partnerships help the company learn about new laws or policy changes early, avoid compliance problems, reduce risks, and plan strategies that follow local regulations for smooth operations everywhere.

Why it’s valuable:

1. Identifies suspicious activity faster and more accurately.

2. Protects users and operators from financial crimes.

3. Meets and exceeds regulatory expectations for player safety.

Example:

Advanced algorithms may autonomously initiate alerts or temporary holds for further review if they detect unusual betting or payment patterns.

In summary:

Tecpinion’s partnership approach is unique because it blends local expertise, adaptive technology, and cutting-edge security — creating a platform that is compliant, agile, and globally scalable.

Distinct Benefits for Operators

-

Risk as Opportunity

What it means: In each market, Tecpinion collaborates with local legal and regulatory professionals. These partnerships assist the organization in anticipating the implementation of new regulations and policy changes prior to their official implementation.

Why it matters:

1. Turns compliance into a brand strength.

2. Builds long-term sustainability in tightly regulated industries.

3. Positions operators as responsible, future-ready leaders.

Example:

When new responsible gaming rules appear, Tecpinion’s proactive framework lets operators implement them first — gaining both compliance and reputation advantages. -

Seamless Global Expansion

What it means:

Tecpinion's adaptable compliance systems and local legal partnerships enable operators to enter new regions with confidence and speed.

Why it matters:

1. Faster go-to-market across multiple jurisdictions.

2. Lower legal and operational risk during expansion.

3. Smooth integration with local payment methods, currencies, and regulations.

Example:

An operator expanding from Europe into Latin America can launch within weeks, not months — with localized compliance and payments ready from day one. -

Player-Centric Operations

What it means:

Tecpinion, as a trusted provider, delivers solutions built around the player experience — supporting multiple currencies, ensuring transparent financial flows, and maintaining strong compliance to build user trust.

Why it matters:

1. Increases player trust and retention.

2. Offers localized experiences without technical complexity.

3. Ensures smooth, transparent transactions across regions.

Example:

A player sees fair conversion rates, clear withdrawal terms, and feels secure — leading to longer engagement and stronger brand loyalty. -

Operational Agility

What it means: While Tecpinion manages the complex, ever-changing regulatory landscape, operators are free to focus on core business priorities — growth, marketing, player retention, and innovation.

Why it matters:

1. Reduces compliance workload.

2. Enables faster decision-making and innovation.

3. Keeps operations lean and scalable.

Example:

As new AML rules roll out in one region, Tecpinion’s backend updates automatically — no downtime, no manual changes, and no distraction from business growth.

In summary:

Tecpinion empowers operators to grow globally with confidence, stay compliant effortlessly, and deliver superior player experiences — turning complexity into a strategic advantage.

Interested in Gaming?

Future-Proofing Through Partnerships

Future-proofing through partnerships means working closely with experts, specialized companies, or industry leaders so your business can anticipate changes and stay ahead of the curve. Instead of trying to predict the future alone, you leverage others’ experience, insights, and technology.

-

Anticipating Regulatory Changes:

Regulations are always changing, especially in sectors like finance and healthcare. By partnering with legal experts and industry groups, businesses can predict these changes and adjust early, avoiding fines or disruptions.

-

Exploring Emerging Markets and Payment Solutions:

New technologies like cryptocurrencies and digital wallets are reshaping payments. Partnering with fintech companies allows businesses to adopt these innovations early, giving them more payment options and access to new markets and customers.

-

Strengthening Compliance and Risk Management:

Threats to cybersecurity and other hazards are increasing. Businesses can be safeguarded from emerging threats by collaborating with cybersecurity and risk management professionals to maintain compliance and security.

Conclusion

Tecpinion’s position is that of a strategic associate, as opposed to a mere technology or platform provider. In addition to providing software solutions, Tecpinion collaborates with operators to address the changing landscape of regulations, market dynamics, and technological advancements. This partnership-focused, collaborative approach enables clients to remain resilient in the face of future challenges and to discover new growth opportunities. Key focus areas include:

- Proactive Compliance: Tecpinion assists businesses in staying abreast of regulatory trends by ensuring that their operations are in accordance with global standards and the implementation of adaptable compliance solutions.

- Multi-Currency Flexibility: Tecpinion makes cross-border operations easy by supporting digital wallets, multiple currencies, and modern payment solutions.

- Operational Growth: The platform is built for scalability—empowering operators to expand into new markets, streamline workflows, and optimize performance through continuous innovation and data-driven insights.

Partnering with Tecpinion is key to sustainable global growth. But how does Tecpinion make this possible? By empowering your business to expand strategically, navigate complexities confidently, and thrive through innovation, compliance expertise, and future-ready solutions.

FAQs

- What role do partnerships play in Tecpinion’s compliance solutions?

Tecpinion collaborates with regulatory bodies and financial institutions to streamline compliance, keeping operators informed and up-to-date with ever-changing regulations.

- How does Tecpinion address multi-currency payment challenges?

Tecpinion's partnerships with leading payment providers offer seamless, secure multi-currency payment processing, reducing risks and complexities for global operators.

- What makes Tecpinion’s approach different from others?

Tecpinion combines local expertise, global partnerships, and advanced technology to ensure clients stay ahead in compliance and manage multi-currency payments efficiently.

- Can Tecpinion help with cross-border payment solutions?

Yes, Tecpinion’s global partners make cross-border payments easy, helping operators follow different financial rules and support various payment options.