How RegTech is Reshaping iGaming Compliance and Risk Management

Table of Contents

- Introduction

- What is RegTech?

- Benefits of RegTech Adoption in iGaming

- Applications of RegTech in iGaming Compliance

- Key Capabilities of RegTech Solutions

- The Compliance and Risk Landscape in iGaming

- Challenges and Limitations

- Trends in RegTech for iGaming

- Choosing the Right RegTech Solution

- The Future of RegTech in iGaming

- Conclusion

- FAQs

Introduction

The iGaming industry has experienced rapid growth in recent years, driven by advancements in technology, increased internet access, and rising global interest in online gaming. As the industry expands into more countries, it faces increasingly complex rules and regulations. The fact that each country has its own rules on matters such as licenses, player safety, and data privacy makes it more challenging for companies to comply with these regulations. RegTech has grown into a useful tool that can help with this. RegTech uses automation and data tools to help companies manage compliance and reduce risk, making it easier to follow rules while staying efficient and building trust with customers. Here, we look at how RegTech is driving change in iGaming compliance and risk management.

Current Market Stats

The global iGaming market increased from about $70 billion in 2022 to $85.6 billion in 2023 and reached approximately $97 billion in 2024. It is projected to grow to $125.6 billion by 2027.

What is RegTech?

RegTech, short for Regulatory Technology, is the use of technology to help businesses follow rules and regulations more easily. It simplifies compliance tasks, improves risk management, and lowers the cost and effort needed to stay within legal guidelines.

RegTech helps organizations automate tasks like monitoring, reporting, and following regulatory rules. It is especially helpful in industries like finance, insurance, and healthcare, where rules change often and it can be difficult to keep up with compliance requirements.

Definition and Scope of RegTech: RegTech covers a broad range of technology-driven solutions aimed at regulatory compliance and risk management. The scope includes, but is not limited to:

- Risk Management and Mitigation: Finding risks in the business or financial environment, measuring them, and taking care of them.

- Compliance Monitoring: Ensuring that businesses adhere to regulatory requirements in real-time.

- Data Management and Reporting: Collecting, organizing, and securely storing data for regulatory reporting and audit purposes.

- Fraud Detection: Using advanced tools to detect fraudulent activities in financial transactions, insurance claims, etc.

- Anti-Money Laundering & Know Your Customer (KYC): Tools that help detect suspicious activities and validate customer identities to prevent financial crimes.

Benefits of RegTech Adoption in iGaming

1. Reduced Compliance Costs

- Application: RegTech automates many of the tasks associated with compliance—such as KYC checks, AML monitoring, and regulatory reporting—reducing the need for manual intervention and lowering labor costs.

- Benefit: By automating routine compliance processes, iGaming operators can significantly reduce overhead costs. The efficiency gains also reduce the need for extensive compliance teams, saving both time and resources while still meeting stringent regulatory requirements.

2. Faster Onboarding and Improved User Experience

- Application: With digital ID verification, biometric authentication, and AI-driven KYC checks, RegTech speeds up the onboarding process by allowing instant or near-instant verification of player identities.

- Benefit: Players can quickly start enjoying their experience without long waits, improving customer satisfaction. A smooth and seamless registration process also reduces friction for new users, encouraging higher sign-up rates and boosting player retention.

3. Minimized Risk of Regulatory Breaches

- Application: Real-time monitoring and AI-powered compliance checks help iGaming platforms solutions quickly identify and address potential compliance issues, such as suspicious transactions, underage gambling, or non-compliant advertising practices.

- Benefit: With automated compliance and continuous monitoring, operators can reduce the risk of inadvertently breaching regulations. This proactive approach ensures adherence to legal frameworks, minimizing the likelihood of fines, penalties, and damage to reputation.

4. Enhanced Agility in Adapting to New Regulations

- Application: RegTech solutions are designed to be flexible and scalable, meaning they can easily be updated to reflect changes in local or international regulatory requirements. For example, automated systems can be quickly reconfigured to meet new anti-money laundering or responsible gambling regulations.

- Benefit: This flexibility allows iGaming operators to rapidly adapt to new or evolving regulations across different jurisdictions, ensuring ongoing compliance and maintaining operations without delays. This adaptability helps businesses stay ahead in a highly regulated, fast-changing industry.

5. Improved Data Security and Privacy

- Application: To keep player information like personal identification data and financial activities safe, RegTech solutions often use advanced encryption, blockchain technology, and decentralized data management.

- Benefit: RegTech platforms help iGaming operators follow strict data protection rules like GDPR or the California Consumer Privacy Act (CCPA) by making sure that data is stored and processed safely. This builds trust among players and lowers the chance of data breaches, which can cost a business money and hurt its image.

Would You Like to Explore More about iGaming ?

Applications of RegTech in iGaming Compliance

A. Automated KYC & Onboarding

-

Digital ID Verification:

Application: Digital ID verification lets iGaming platforms confirm players’ identities online. Players upload IDs like passports or driver’s licenses, which are checked automatically.

Benefit: This cuts down on the risk of identity fraud, speeds up the hiring process, and makes sure that Know Your Customer (KYC) rules are followed. -

Biometric Checks:

Application: Biometric checks, including facial recognition or fingerprint scanning, add an extra layer of security in the identity verification process. They are particularly useful in ensuring that the person registering is the one interacting with the platform.

Benefit: They provide a high level of accuracy and fraud prevention, which is crucial for regulatory compliance in jurisdictions that require stringent identity verification. -

Sanctions and PEP Screening :

Application: RegTech tools use AI to check players against global sanctions and PEP lists, helping operators avoid high-risk individuals.

Benefit: Makes sure that iGaming platforms follow anti-money laundering and counter-terrorism financing (CTF) rules by checking players' information when they sign up and regularly after that.

B. AML Transaction Monitoring

-

Real-time Detection of Suspicious Behavior:

Application:Real-time transaction tracking systems that use AI and machine learning can spot betting patterns or deposit/withdrawal activities that don't seem right and could be signs of money laundering.

Benefit: This allows operators to act swiftly to prevent illicit activities, ensuring they are compliant with AML regulations and protecting the integrity of the platform. -

Pattern Recognition Using AI:

Application: AI-based systems look at huge amounts of transactional data to find trends that look fishy, like betting in strange ways, cashing out quickly, or making a lot of deposits all at once, which are all signs of money laundering.

Benefit: AI algorithms can learn and change all the time, which makes it easier for the system to spot new or changing ways of moving money and gives compliance teams more accurate alerts to look into.

C. Licensing and Jurisdictional Compliance

-

Cross-Border Compliance Tools:

Application: RegTech solutions help iGaming platforms comply with the various regulatory requirements across multiple jurisdictions. These tools can automatically adjust compliance checks and operations according to local laws, whether it's about tax obligations, player protections, or advertising restrictions.

Benefit: Makes sure that operators can give their services in multiple markets without breaking any local laws. This lowers the risk of getting in trouble with the law and getting fined a lot. -

Automated Reporting for Multiple Jurisdictions:

Application: Many jurisdictions require regular, detailed reporting from iGaming operators. RegTech platforms can automatically generate and submit these reports in the required format, ensuring that all data is accurately presented and compliant with local regulations.

Benefit: Automation makes things easier for operators by reducing the amount of paperwork they have to do and reducing the chance of mistakes. This helps the operator stay in good standing with different regulatory bodies.

D. Responsible Gambling Tools

-

Behavioral Analytics to Identify Problem Gambling:

Application: RegTech solutions use advanced data analytics and AI to monitor player behavior for signs of problem gambling. By analyzing betting patterns, frequency, and monetary behavior, the system can flag players who may be at risk of gambling addiction.

Benefit: Offers managers the chance to help players who are at risk by stepping in, giving them support tools, or encouraging them to gamble responsibly. -

Self-Exclusion and Affordability Checks:

Application: RegTech tools make self-exclusion automatic, so players can choose to limit how much they gamble on their own. Additionally, they check players' budgets to make sure they don't spend more than they can afford, which promotes responsible gaming.

Benefit: Keeps players safe from addiction and helps operators follow responsible gambling rules.

E. Audit Trail and Reporting Automation

-

Transparent and Immutable Audit Logs:

Application: RegTech platforms keep permanent records of all contacts and transactions that happen on the platform. This makes sure that all actions are recorded, time-stamped, and can't be changed. This makes them legal for regulators to look over.

Benefit: An unchangeable audit log makes things clear, which is important for audits, investigations, and reporting to regulators. This lowers the chance of fraud or not following the rules. -

Simplified Reporting to Regulators:

Application: Automated reporting tools simplify the process of preparing and submitting reports to regulators. These tools can aggregate the necessary data, format it according to jurisdictional requirements, and submit it in real-time or on a regular schedule.

Benefit: Simplifies the compliance process, reduces the manual effort required for regulatory reporting, and ensures that reports are accurate and timely, helping operators avoid fines and penalties for non-compliance.

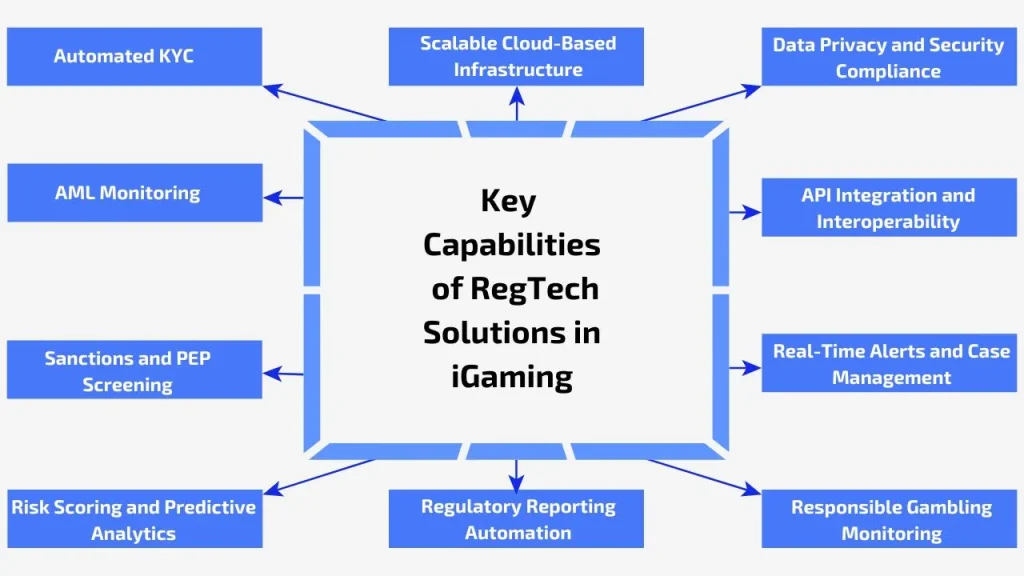

Key Capabilities of RegTech Solutions in iGaming

RegTech solutions have many features that make it easier to follow the rules, make things safer, and run more smoothly in the iGaming industry, where following the rules and keeping players safe are very important.

Automated KYC (Know Your Customer):

- Verify identities with documents, facial recognition, and biometrics

- Faster onboarding by instantly checking player details

- Ongoing checks for returning users.

AML Monitoring:

- Tracking of player deals in real time to find fishy behaviour

- Pattern detection based on AI to flag dangerous behaviours

- Rules and thresholds that can be changed to fit the needs of each state

Sanctions and PEP Screening:

- Automated screening against global watchlists, sanctions, and Politically Exposed Persons databases

- Continuous monitoring for any changes in user status

- Maintaining audit logs for all screenings and decisions

Risk Scoring and Predictive Analytics:

- Assigning risk scores based on behavior, location, transaction patterns, and more

- Predictive analytics to identify compliance risks before violations occur

- Enabling proactive compliance management and decision-making

Regulatory Reporting Automation:

- Automated generation of reports required by regulators in the correct formats

- Support for multi-jurisdictional reporting with localization features

- Secure, time-stamped, and auditable reporting logs

Responsible Gambling Monitoring:

- Behavioral analytics to detect signs of problem gambling

- Automated alerts and interventions based on predefined criteria

- Help for self-exclusion, cooling-off times, and checks on affordability

Real-Time Alerts and Case Management:

- Immediate notifications for suspicious or non-compliant behavior

- Dashboards for compliance teams to review, escalate, and resolve cases

- Workflow automation to reduce manual workload

API Integration and Interoperability:

- It is easy to connect to iGaming platforms, CRM systems, payment methods, and third-party tools that are already in use.

- Flexible API architecture to customize workflows

- Support for cross-border compliance and regulatory requirements

Data Privacy and Security Compliance:

- Consent management and data minimisation are two built-in tools that help you comply with GDPR.

- Encryption of sensitive data both at rest and in transit

- Secure access controls and detailed audit trails

Scalable Cloud-Based Infrastructure:

- Cloud-native solutions that scale with user growth and transaction volume

- High availability and reliable uptime

- Global data center support to meet jurisdictional data hosting requirements

The Compliance and Risk Landscape in iGaming

Overview of Key Regulatory Challenges

- Anti-Money Laundering: iGaming operators must detect and prevent money laundering activities by monitoring player transactions, identifying suspicious behavior, and reporting to authorities as required by law.

- KYC (Know Your Customer):

To stop fraud and underage people from gaming, operators are required to use safe and reliable methods to make sure players are who they say they are.

- Responsible Gambling Requirements:

Ensuring player protection by implementing tools and policies that identify problem gambling behavior, provide self-exclusion options, and promote responsible gaming practices.

- Licensing and Jurisdictional Compliance: Operators must adhere to the specific licensing requirements and regulations of each jurisdiction in which they operate, which can vary widely and often require localized compliance efforts.

Risks Facing iGaming Operators

- Regulatory Fines:

Non-compliance with laws and regulations can lead to substantial financial penalties, legal action, and even loss of operating licenses.

- Reputational Damage:

Failing to meet compliance standards can harm the operator’s reputation, resulting in loss of customer trust and market share.

- Fraud and Financial Crime: Operators face risks from fraud, money laundering, and other financial crimes that can undermine the integrity of the platform and cause significant financial and operational harm.

Want to Explore More about iGaming

Challenges and Limitations

RegTech can help with iGaming compliance in a lot of ways, but it’s not always easy to use. Most of the time, these problems are caused by technological, legal, or operational issues that make RegTech remedies less effective or efficient. Here are some of the most important problems and restrictions:

-

Integration with legacy systems:

1. Many iGaming operators still use older software or systems, called legacy systems.

2. New RegTech solutions may not easily connect with these older systems.<br.3. This can cause technical issues, slow down adoption, or require costly custom development to make everything work together. -

Data privacy and GDPR concerns:

1. RegTech often deals with sensitive player data (like IDs, payment info, and game behavior).

2. Regulations like GDPR (General Data Protection Regulation) require strict handling of personal data.

3. Ensuring compliance is tricky because mishandling data can lead to fines, reputational damage, or legal issues. -

Vendor reliability and over-reliance on automation:

1.iGaming operators depend on third-party RegTech providers for compliance tools.

2. If the vendor fails, the operator might face compliance gaps or operational disruptions.

3. Over-reliance on automation can also be risky: automated checks may miss complex fraud or regulatory nuances that require human judgment. -

Regulatory acceptance and evolving standards:

1. Different countries and jurisdictions have different rules for iGaming and compliance.

2. Regulators may be slow to recognize or approve new RegTech tools, creating uncertainty.

3. Rules change frequently, so solutions must adapt continuously, which can be costly and challenging.

Trends in RegTech for iGaming

1. Predictive Compliance

- Definition: Predictive compliance uses advanced analytics and AI to anticipate compliance risks before they occur, rather than simply reacting to violations after the fact.

- How It Works: Machine learning models look at past player actions, transaction data, and outside risk signs to predict problems that might happen, like AML violations, problem gambling, or regulatory breaches.

- Impact on iGaming:

- Early detection of non-compliance risks

- Proactive mitigation strategies

- Fewer penalties and stronger regulatory relationships

2. Interoperability Between Jurisdictions

- Definition: The ability for RegTech systems to operate seamlessly across multiple regulatory frameworks and jurisdictions, using standardized protocols and data formats.

- Why It Matters: iGaming operators often serve players in several countries, each with different rules. Interoperability allows for centralized compliance while meeting local legal requirements.

- Trends:

- Development of global or regional compliance standards (e.g., similar to GDPR in data privacy)

- Growth of modular, API-first RegTech platforms that can plug into various regulatory environments

- Impact on iGaming:

- Simplified licensing processes

- Lower cost and complexity of multi-jurisdictional compliance

- Greater scalability for operators expanding into new markets

3. AI-Driven Decision-Making

- Definition: Moving beyond automation to AI-enabled strategic decisions, where systems not only detect anomalies but also recommend — or even take — specific compliance actions.

- Dynamic risk scoring for players and transactions

- Automated affordability assessments based on real-time data

- Personalized responsible gambling interventions

- Enhanced compliance accuracy

- Faster response times

- Reduced need for manual review

4. Role of Regulators in Supporting RegTech Adoption

Trend: Regulators are becoming more open and proactive in supporting RegTech adoption, recognizing its value in improving compliance and protecting players.

What’s Changing:

- Regulatory sandboxes allowing operators to test RegTech solutions in a supervised environment

- Collaborative development of tech standards and compliance frameworks

- Increased guidance on acceptable use of AI and automation

- Stronger public-private partnerships between regulators and technology providers

- Shift toward real-time, continuous regulation, where regulators can monitor key compliance indicators via direct integration with operator systems

| Trend | Impact on iGaming |

| Predictive Compliance | Enables proactive risk management and fewer regulatory penalties |

| Interoperability | Simplifies operations across multiple jurisdictions and supports global expansion |

| AI-Driven Decision-Making | Delivers faster, more accurate compliance responses with reduced human workload |

| Regulatory Support | Encourages innovation while ensuring technology remains aligned with legal frameworks |

Choosing the Right RegTech Solution for iGaming

Selecting the right RegTech solution is vital for iGaming operators to stay compliant, streamline operations, and scale smoothly across jurisdictions. A strategic, informed approach is essential in today’s fast-changing regulatory landscape. At Tecpinion, we understand the unique challenges iGaming operators face — from keeping up with constantly changing regulations to delivering a smooth and engaging user experience. Our RegTech solutions are purpose-built for the iGaming industry, combining advanced AI, data analytics, and automation with deep domain expertise. This allows you to monitor real-time compliance, detect risks before they escalate, and scale operations efficiently without compromising player trust.

With Tecpinion, you get more than technology—you get a partner that helps you stay compliant, competitive, and ready to grow. Whether launching a new platform or improving an existing one, our solutions give the efficiency, insights, and security you need to succeed in iGaming.

The Future of RegTech in iGaming

The future of RegTech in iGaming is promising, fueled by industry growth and tightening regulations. It will automate key compliance tasks like identity verification, transaction monitoring, and reporting. AI and machine learning will enhance fraud detection—spotting collusion, bonus abuse, and money laundering—by analyzing player behavior in real time. How will this shape the industry? Making compliance faster and more accurate, and why it matters, is that operators can protect both players and their reputation.

Cross-border compliance will become easier as RegTech tools adapt to different regional laws and tax systems. Blockchain may enhance security and transparency, while responsible gambling tools will use AI to identify risky behavior and trigger alerts or self-exclusion.

RegTech will also simplify audits, personalize customer checks, and ensure data privacy under laws like GDPR. With seamless integration into gaming platforms, these tools will improve efficiency, reduce costs, and build player trust—giving iGaming companies a clear competitive advantage.

Conclusion

RegTech is changing B2B solutions for iGaming compliance and risk management by using AI, big data, and automation. It helps operators work proactively, cut costs, and stay compliant in real time across different regions. From streamlined KYC and AML processes to automated reporting and responsible gambling monitoring, RegTech empowers iGaming platforms to enhance efficiency, protect players, and maintain regulatory trust.

As regulations tighten and players expect more, using modern compliance tools is essential. Smart operators see RegTech not just as a requirement, but as a way to grow, scale, and stay successful long-term.

FAQs

- What is RegTech in the iGaming industry?

RegTech, which stands for "Regulatory Technology," is are tech-based solutions that help iGaming companies follow the rules, make sure they're doing everything the right way, and lower risks like fraud and money laundering.

- Why is RegTech important for iGaming compliance?

The iGaming business has to deal with strict rules that are always changing in many places. RegTech makes compliance faster and more reliable by ensuring accurate reporting, real-time tracking, and automated risk management.

- How does RegTech improve risk management in iGaming?

RegTech tools look at information about players, mark deals that seem sketchy, and use AI and machine learning to spot strange behavior. This helps owners find fraud, money laundering, or gambling problems early on.

- How does RegTech help with Anti-Money Laundering compliance?

RegTech automates AML checks by verifying player identities (KYC), monitoring transactions in real time, and generating reports for regulators—reducing manual errors and ensuring faster detection of suspicious activity.

- What challenges do iGaming operators face when adopting RegTech?

Problems include combining RegTech with older systems, making sure that GDPR and data privacy rules are followed, not relying too much on automation, and keeping up with laws that change all the time.

- Can RegTech solutions adapt to different jurisdictions?

Yes. Many RegTech tools are designed to handle multi-jurisdictional compliance, automatically updating rules and processes based on regional laws, which is crucial for global iGaming operators.

- How does RegTech save costs for iGaming companies?

By automating compliance and reporting, RegTech reduces the need for large compliance teams, minimizes fines for regulatory breaches, and lowers operational costs.

- What is the future of RegTech in iGaming?

The future points to deeper AI integration, predictive risk management, blockchain-powered transparency, and seamless cross-border compliance, making the industry safer and more efficient.